AHALTS Auto KYC

Introduction: Welcome to the future of compliance! AHALTS Auto KYC is a groundbreaking solution designed to streamline and automate the Know Your Customer (KYC) process, revolutionizing how organizations manage compliance requirements while enhancing efficiency and security.

Biometric Devices

Ahalts Biometric Series powered by Facial Technology and 5th Gen AI Driven Devices to secure user management with Cloud Auto User Registration Service with KYC Verification providing authentication services integrated to AHALTS IAM Platform

Turnstiles

- Barrier open/closed, free accessing, forbidden mode are selectable.

- Bidirectional (entering/exiting) lane

- LED indicates the entrance/exit and passing status.

- Fire alarm passing: when the fire alarm is triggered, the barrier will be dropped automatically for emergency evacuation.

- Valid passing duration settings: system will cancel the passing permission if a person does not pass through the lane within the valid passing duration.

- With key buttons to configure turnstile’s functions and parameters offline.

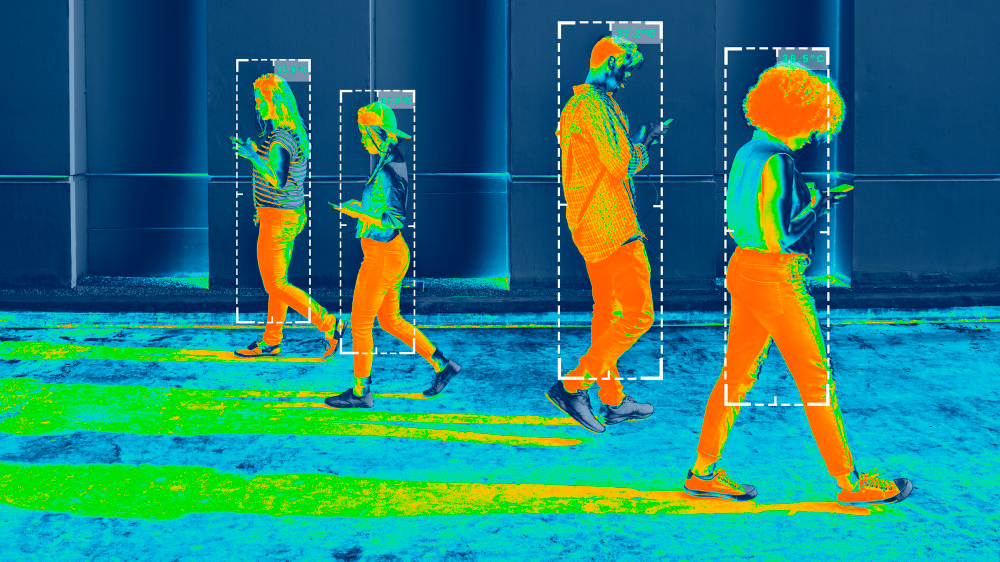

Thermal Camera

Ahalts FZCo Planet possesses full range of mid to long

distance imaging cameras and photo-electronic

devices, consisting of:

distance imaging cameras and photo-electronic

devices, consisting of:

Kiosks

This revolutionary device is a product of years of research of Tip Top R&D teams.

Key Features:

- Advanced Data Management: Leverage advanced data management capabilities to efficiently gather, organize, and verify customer information with precision and accuracy.

- Register Identity based on unique Username, Password, Facial and biometric. Automated Verification Processes: Say goodbye to manual verification headaches.

- AHALTS Auto KYC automates the verification process, minimizing errors and maximizing efficiency.

- Real-Time Monitoring: Stay ahead of compliance requirements with real-time monitoring of customer data and activities, ensuring proactive identification and mitigation of compliance risks..

- Cost-Efficient Compliance: Reduce operational costs associated with clerical HR work Secure Access Controls: Implement stringent access controls and permission levels to safeguard customer information and ensure compliance with data privacy regulations.

- Seamless Integration: Integrate AHALTS Auto KYC seamlessly into existing systems and workflows, minimizing disruption and maximizing efficiency.

- Expert Support: Benefit from dedicated support and expertise from our team of compliance specialists, ensuring smooth implementation and ongoing support for your compliance needs.

Benefits:

- Increased Efficiency: Automate manual processes and reduce the time and resources required for KYC compliance.

- Enhanced Security: Ensure the confidentiality and integrity of customer data with robust security measures.

- Proactive Compliance: Stay ahead of regulatory requirements with real-time monitoring and proactive risk mitigation.

- Real-Time Monitoring: Stay ahead of compliance requirements with real-time monitoring of customer data and activities, ensuring proactive identification and mitigation of compliance risks..

- Cost-Efficient Compliance: Reduce operational costs associated with clerical HR work Secure Access Controls: Implement stringent access controls and permission levels to safeguard customer information and ensure compliance with data privacy regulations.

- Cost Savings: Reduce operational costs associated with compliance efforts through automation and streamlined processes..

- Improved Customer Experience: Enhance the onboarding experience for customers with faster and more seamless verification processes.

Conclusion

Experience the power of automation with AHALTS Auto KYC. Contact us today to learn more about how our innovative solution can transform your KYC processes and propel your organization towards compliance excellence.